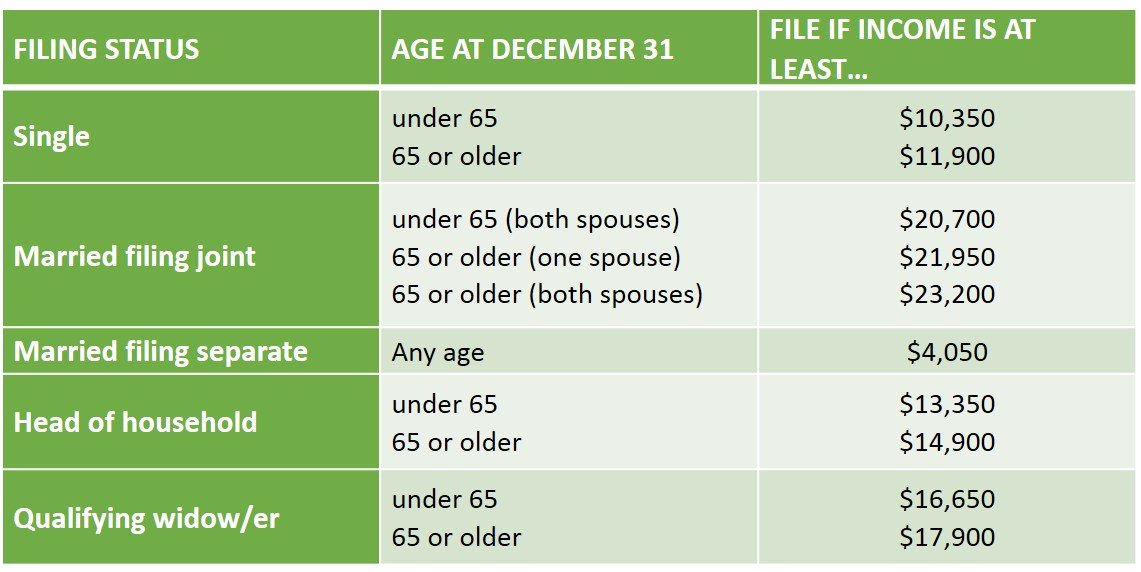

Minimum Taxable Income 2025. In 2025 and 2025, there are seven federal income tax rates and brackets: 2025 personal tax calculator | ey canada.

For tax bracket rates for all other provinces and territories, please scroll down for the full list below. 29% on taxable income over $173,205 up to $246,752.

The top federal tax rate of 33 per cent currently kicks in at an income of more than $246,752 for 2025.

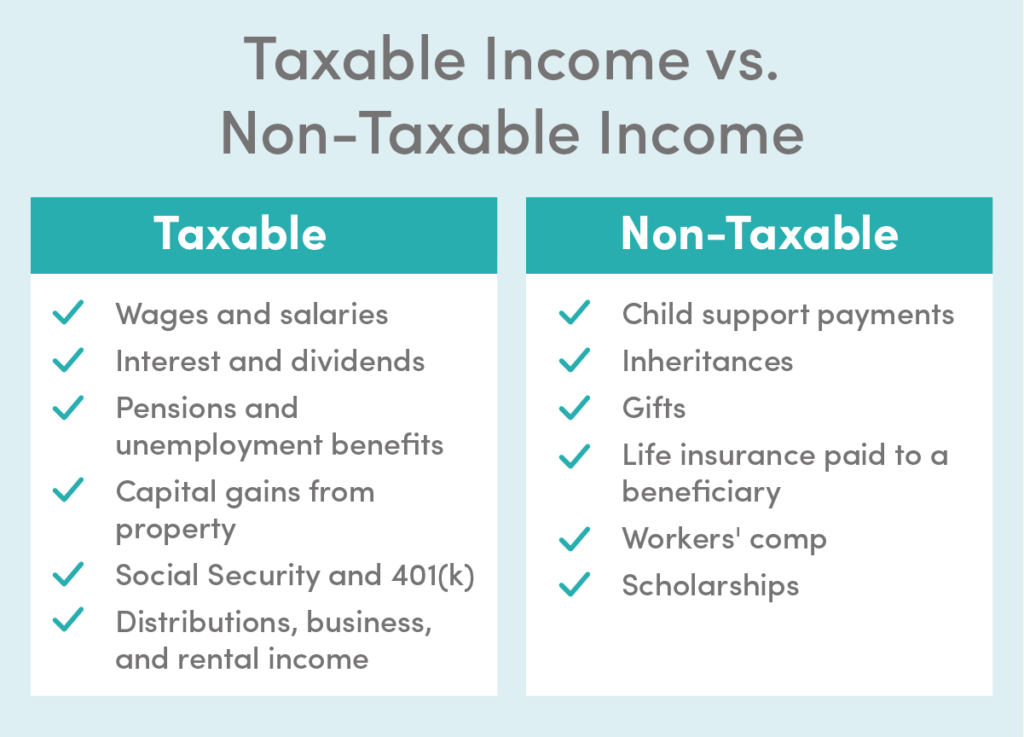

Maximize Your Paycheck Understanding FICA Tax in 2025, Since the regular tax ($107,745) is more than the. Taxable income and filing status determine which federal tax rates.

Tax rates for the 2025 year of assessment Just One Lap, The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5% increase), except. Therefore, 102,500 + 50,000 = 152,500 tax due.

When Should You File A U.S. Federal Tax Return AG Tax When, Check out the latest income tax slabs and rates as per the new tax regime and old tax regime. Effective from february 1, 2025,.

Taxable Formula financepal, You can earn a personal income of up to $15,000 without paying federal taxes in canada for the 2025 taxation year, which will be indexed for inflation in subsequent years. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Table 3317 (1) Comparison of Minimum Taxable Tax, Taxable income and filing status determine which federal tax rates. Basic amount will be 102,500.

2025 Tax Rates & Federal Tax Brackets Top Dollar, Calculate your combined federal and provincial tax bill in each province and territory. You would fall into the “more than $16,550” bracket and your tax rate would.

Key Actions for Tax Leaders on Global Minimum Tax, Canada’s income tax brackets for 2025, plus the maximum tax you’ll pay based on income. In 2025, the first $55,867 would be taxed at 15 per cent ($8,380.05) while the remaining portion would be taxed at 20.5 per cent ($847.26).

Figure 2118 Trends of the Real Minimum Taxable by, In 2025, the first $55,867 would be taxed at 15 per cent ($8,380.05) while the remaining portion would be taxed at 20.5 per cent ($847.26). The amt exemption of $173,000 is deducted, leaving adjusted taxable income of $227,000, and minimum tax of $46,535 (at 20.5%).

Ranking Of State Tax Rates INCOBEMAN, My bet is that a general increase in the. In total, that adds up to $9,227.31.

Here are the federal tax brackets for 2025, From $14,156 to $15,705 for taxpayers with net income (line 23600) of. 29% on taxable income over $173,205 up to $246,752.

The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5% increase), except.